Note: This text has been automatically extracted via Optical Character Recognition (OCR) software.

Fourth Division Op Pkomts. Clerical, Med...

FOURTH DIVISION OP PKOMTS . CLERICAL , MEDICAL , AND GENERAL LIFE ASSURANCE SOCIETY . REPORT OP THE DIRECTORS TO THE PROPRIETORS AND ASSURED , Read at an Extraordinary General Meeting , held at the Society ' s Office ,

on the 7 th January , 1847 . In accordance with the provisions of the deed of constitution , the Directors have called the present meeting , for the purpose of laying before the Proprietors aud the Assured the result of an investigation ofthe Society ' s affairs forthe five years ending June 30 , 1 S 46 . On that day the Society had been in existence twenty-two years . An investigation of its affairs was made first in 1831 , being seven years from the commencement ; a second time in 1836 ; a third time in 1841 . The fourth investigation having been just completed , the Directors have now the gratification of communicating the result to the meeting . In order to present a clear view of the progress of the Society , the Directors will proceed to exhibit the present amount of its funds , together with their state at the last Quinquennial Division .

I . The Society's income for the year ending with June , 1841 , was 97 , 900 ? . ; that for the year ending with June , 1846 , 116 , 300 / . Thus , notwithstanding the many deductions which are constantly taking place , on account of Policies terminated by death , or discontinued from other causes , there is an increase in the annual income of the Society to the extent of 18 , 400 / . II . The amount ofthe property ofthe Society , accumulated from the excess of receipts above payments , was , in 1841 , 418 , 903 / ., and , in 1846 , has reached 639 , 797 / . Under the head of payments , are included considerable sums paid for the purchase of Policies , and also to

annuitants , besides the amount which has become due from deaths and every other demand . III . After deducting the sum required to meet the liabilities of the Society , there remains a surplus of 155 , 242 / . ; while in 1841 , the corresponding surplus was only 89 , 400 / . This sum of 155 , 242 / . has now to be dealt with , being the amount of profit realized by the Society . In conforming with the provisions of the deed , one-half of the profits is to be divided among the Assured for Life , and one-sixth part among the Proprietors ; but , in order to avoid inconvenient fractions , the Directors have resolved to recommend to this meeting to divide the sum of 154 , 500 / . This will apportion to the Assured for Life 77 , 250 / ., and to the Proprietors 25 , 750 / ., leaving one-third of the said profit , amounting to 51 , 500 / ., to be laid by , and to accumulate as a reserved fund .

This division will give to the Proprietors a bonus of 51 . 3 s . per Share , and to the Assured a sum of 114 , 031 / ., being the equivalent in reversion to the above amount of 77 , 250 / . This sum of 114 , 031 / . will be added to the Policies , and be payable at the death of the respective parties , and will form an addition equal , on an average , to more than 36 percent , on the Premiums received during the last five years . It may be desirable , however , to remind the Assured that they have tbe option of having any one " or more of the bonuses to which they are entitled applied in reduction of their future payments of premium .

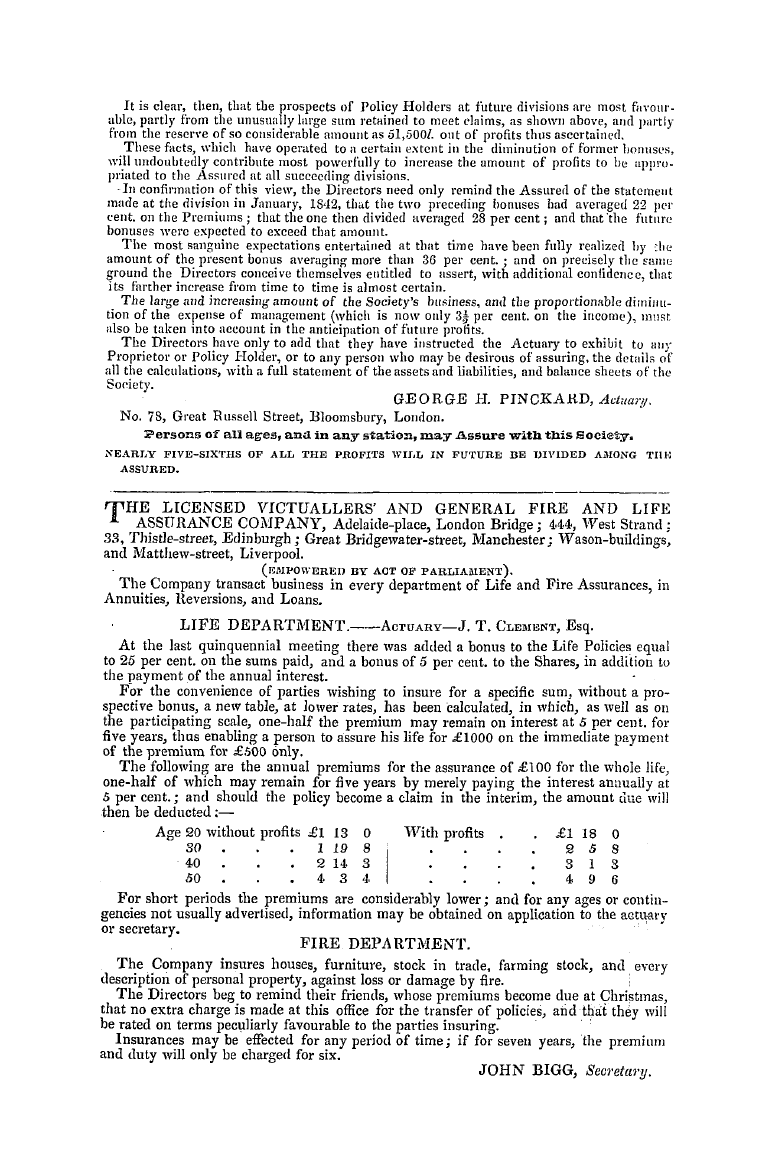

For the further information ofthe Proprietors , it may be mentioned , that by the deed of constitution , the Proprietors'fund is not to accumulate by the addition of bonuses beyond 50 , 000 / . ; all subsequent bonuses being paid over to the Proprietors . The effect of that provision on the present occasion will be , that of the above sum of 25 , 750 / ., 17 , 000 / . will have to be added to the Proprietors' Fund , wliich will then have reached its limit , and the remaining 8 , 750 / ., being 1 / . 15 s . per share , will be paid to the Proprietors in cash at the end of March next . In estimating the amount of liabilities , it is important to observe that every policy , together with all other risks , has been valued separately , and with great care : that there has been no encroachment upon future profits ; but that a mode of valuation has been adopted , whereby a larger sum is . retained to meet such claims as may arise than is usual with most other Offices , This will appear by tbe following examples : —

inXthe " By the mode Difference in ..... „ , Sums set ; aside as , the value of a Polios for £ 1000 . -M „' tS ™„; I , n < t adopted by this favour of this ¦ " ¦ ¦¦ . rvortnampton n offirp Odire __ per cent . Table . "race . __ _ "" - . ¦ r"EE r-. ri r ' i ,-j- - jj , '^ . i- ' ¦ ' £ s - d . £ s . d . . . ; £ ..., s . d . y . ' . ^ Effected fit the age ' . of 40 , after 10 years 152 3 7 158 ' 8 . 5 6 4 10 ' DoJ '" Do . 50 , after 10 years 197 17 3 215 . 2 0 17 4 9 Do . Do . 60 , after 10 years 282 7 5 326 3 0 43 15 7

Note: This text has been automatically extracted via Optical Character Recognition (OCR) software.

Fourth Division Op Pkomts. Clerical, Med...

FOURTH DIVISION OP PKOMTS . CLERICAL , MEDICAL , AND GENERAL LIFE ASSURANCE SOCIETY . REPORT OP THE DIRECTORS TO THE PROPRIETORS AND ASSURED , Read at an Extraordinary General Meeting , held at the Society ' s Office ,

on the 7 th January , 1847 . In accordance with the provisions of the deed of constitution , the Directors have called the present meeting , for the purpose of laying before the Proprietors aud the Assured the result of an investigation ofthe Society ' s affairs forthe five years ending June 30 , 1 S 46 . On that day the Society had been in existence twenty-two years . An investigation of its affairs was made first in 1831 , being seven years from the commencement ; a second time in 1836 ; a third time in 1841 . The fourth investigation having been just completed , the Directors have now the gratification of communicating the result to the meeting . In order to present a clear view of the progress of the Society , the Directors will proceed to exhibit the present amount of its funds , together with their state at the last Quinquennial Division .

I . The Society's income for the year ending with June , 1841 , was 97 , 900 ? . ; that for the year ending with June , 1846 , 116 , 300 / . Thus , notwithstanding the many deductions which are constantly taking place , on account of Policies terminated by death , or discontinued from other causes , there is an increase in the annual income of the Society to the extent of 18 , 400 / . II . The amount ofthe property ofthe Society , accumulated from the excess of receipts above payments , was , in 1841 , 418 , 903 / ., and , in 1846 , has reached 639 , 797 / . Under the head of payments , are included considerable sums paid for the purchase of Policies , and also to

annuitants , besides the amount which has become due from deaths and every other demand . III . After deducting the sum required to meet the liabilities of the Society , there remains a surplus of 155 , 242 / . ; while in 1841 , the corresponding surplus was only 89 , 400 / . This sum of 155 , 242 / . has now to be dealt with , being the amount of profit realized by the Society . In conforming with the provisions of the deed , one-half of the profits is to be divided among the Assured for Life , and one-sixth part among the Proprietors ; but , in order to avoid inconvenient fractions , the Directors have resolved to recommend to this meeting to divide the sum of 154 , 500 / . This will apportion to the Assured for Life 77 , 250 / ., and to the Proprietors 25 , 750 / ., leaving one-third of the said profit , amounting to 51 , 500 / ., to be laid by , and to accumulate as a reserved fund .

This division will give to the Proprietors a bonus of 51 . 3 s . per Share , and to the Assured a sum of 114 , 031 / ., being the equivalent in reversion to the above amount of 77 , 250 / . This sum of 114 , 031 / . will be added to the Policies , and be payable at the death of the respective parties , and will form an addition equal , on an average , to more than 36 percent , on the Premiums received during the last five years . It may be desirable , however , to remind the Assured that they have tbe option of having any one " or more of the bonuses to which they are entitled applied in reduction of their future payments of premium .

For the further information ofthe Proprietors , it may be mentioned , that by the deed of constitution , the Proprietors'fund is not to accumulate by the addition of bonuses beyond 50 , 000 / . ; all subsequent bonuses being paid over to the Proprietors . The effect of that provision on the present occasion will be , that of the above sum of 25 , 750 / ., 17 , 000 / . will have to be added to the Proprietors' Fund , wliich will then have reached its limit , and the remaining 8 , 750 / ., being 1 / . 15 s . per share , will be paid to the Proprietors in cash at the end of March next . In estimating the amount of liabilities , it is important to observe that every policy , together with all other risks , has been valued separately , and with great care : that there has been no encroachment upon future profits ; but that a mode of valuation has been adopted , whereby a larger sum is . retained to meet such claims as may arise than is usual with most other Offices , This will appear by tbe following examples : —

inXthe " By the mode Difference in ..... „ , Sums set ; aside as , the value of a Polios for £ 1000 . -M „' tS ™„; I , n < t adopted by this favour of this ¦ " ¦ ¦¦ . rvortnampton n offirp Odire __ per cent . Table . "race . __ _ "" - . ¦ r"EE r-. ri r ' i ,-j- - jj , '^ . i- ' ¦ ' £ s - d . £ s . d . . . ; £ ..., s . d . y . ' . ^ Effected fit the age ' . of 40 , after 10 years 152 3 7 158 ' 8 . 5 6 4 10 ' DoJ '" Do . 50 , after 10 years 197 17 3 215 . 2 0 17 4 9 Do . Do . 60 , after 10 years 282 7 5 326 3 0 43 15 7